It’s never been easier to learn more about your credit score and history. As a result, people’s scores are higher than ever. Age is an advantage with older Americans having higher credit scores than younger ones. VantageScore, which was created by the credit reporting agencies Experian, TransUnion and Equifax, details this trend. The VantageScore ranges from 300 to 850, with 850 signifying exceptional credit.

Average VantageScore by generation

730 – Silent Generation (born between 1925 and 1946)

700 – Baby Boomers (born between 1947 and 1966)

655 – Generation X (born between 1967 and 1981)

634 – Millennials (born between 1982 and 1995)

631 – Generation Z (born 1996 and later)

There are many reasons why older consumers have better credit score averages than younger consumers.

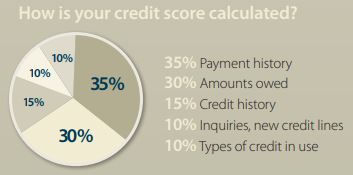

• A long credit history contributes to a higher score. While amounts owed and diversity of credit contribute to your credit score, payment history and credit length

together make up half of the total credit score. Since younger consumers, especially those under the age of 25, have relatively short credit histories, it can be

challenging to achieve stellar credit.

• Younger consumers may not have a well-rounded mix of credit types, including a mortgage, car loan, credit cards, etc. While they may have student loans and a credit card or two, they may not have had the need to purchase a home or new car as the older generations did at that age.

• Younger consumers tend to have lower incomes than older consumers. Since many are at the beginning of their careers, they’ll likely earn less than others who are

well-advanced into their careers or retired. As a result, they may not qualify for high credit limits, which would lower their debt-utilization ratio. Additionally, it’s often challenging, though not impossible, to take control of debt with a low income.

The good news is, over time the score will increase, especially if you utilize these habits:

• Keep making payments on time. You’ll build habits with each payment you make.

• Use credit responsibly. If possible, avoid new inquiries and opening new accounts.If you’re rate shopping, do so within a small window so it doesn’t raise any flags on

your credit.

• Avoid carrying high balances on your credit cards. Pay down your debt and keep your balance less than 35 percent of your total available credit.

Home Selling Resources

| Complete Guide to Home Selling | Get a Free Consultation on Selling Your Home |

| 10 Tips to Selling Your Home | How to Prepare Your Home for Sale |

| Find Out What Your Home is Worth |

Home Buying Resources

| Search Homes For Sale Now | View Open House List |

| Home Buying Process – A Complete Guide | 7 Tips to Home Buyer Success |

| Free Home Buyer Consultation | Why You Need A Buyers Agent |